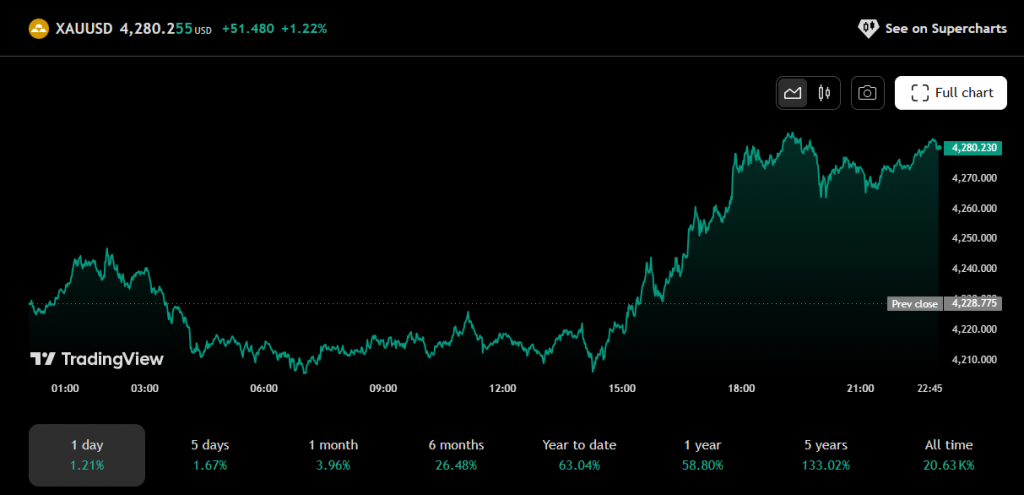

As we approach the end of the week, it’s time to take a closer look at the Gold (XAU/USD) market performance for the week ending December 12, 2025. This analysis will cover the technical, fundamental, and legal aspects that have influenced gold’s price action, providing an all-encompassing view of this week’s market movements.

Technical Analysis

Price Action & Key Levels:

- Opening Price (December 7, 2025): Gold opened the week around the $4260 level, having previously been trading in a consolidation range for the last few weeks, following a series of strong rallies earlier in the year.

- Highs and Lows: Over the course of the week, gold saw some volatility, with prices reaching a weekly high of $4305 on December 9, 2025, before facing a slight pullback toward the $4240 region by the end of the week.

RSI (Relative Strength Index):

- The RSI for XAU/USD was hovering around 70-75 for most of the week, signaling an overbought condition in the market. This aligns with the observed pullbacks as the market saw a small correction due to overextended bullish sentiment.

- On December 9, the RSI briefly surged above 80, marking an overbought zone, triggering concerns among traders about the potential for a short-term reversal.

EMA (Exponential Moving Averages):

- EMA 50 remained above the EMA 200 for much of the week, which traditionally signals a bullish trend in the short-to-medium term.

- However, the price briefly tested the EMA 50 support at around $4230 before bouncing back, indicating that the short-term trend is still holding. EMA 200, sitting below the current price levels, suggests that the long-term bullish trend remains intact despite minor corrections.

Support and Resistance Levels:

- Key Support: $4230, which coincides with the EMA 50 and also serves as a prior support level from the beginning of December.

- Key Resistance: $4305, the weekly high, which was briefly touched before facing selling pressure. This level is crucial for gauging whether gold will continue its bullish momentum or enter a consolidation phase.

Fundamental Analysis

Global Economic Conditions:

- US Dollar (USD) Strength: The US Dollar experienced some strength this week, with the Dollar Index (DXY) climbing, especially after the US Federal Reserve’s hawkish statements on interest rates. This pressured gold slightly as the inverse relationship between the USD and gold is a well-known market dynamic.

- Interest Rates & Inflation: Market participants remain focused on inflationary pressures and interest rate decisions. The Fed’s stance on interest rates remained relatively unchanged, but persistent inflationary concerns kept investors flocking to gold as a hedge against currency devaluation.

- Geopolitical Risk: Gold’s role as a safe-haven asset continued to be supported by ongoing geopolitical tensions in the Middle East and concerns around global trade, which sparked buying demand in precious metals.

Market Sentiment:

- Inflation Hedge: Traders continued to view gold as an effective hedge against inflation. With concerns over global economic instability and the potential for further inflationary pressure, gold maintained its status as a preferred asset for portfolio diversification.

- Institutional Buying: Some larger institutions, including central banks, were also reported to have increased their gold holdings this week, driving demand in the market. This is consistent with the trend seen over the past year, where many banks sought to reduce their reliance on the US Dollar and diversify into precious metals.

Legal & Regulatory Environment

US Federal Reserve Actions:

- This week, the US Federal Reserve provided some clarity on future monetary policy, with their hawkish tone continuing to suggest that interest rates may remain elevated into 2026 to curb inflation. This could put pressure on gold in the short term, as higher interest rates tend to benefit yield-bearing assets (like US Treasuries) at the expense of non-yielding gold.

Global Trade Relations:

- US-China trade relations and geopolitical tensions in Eastern Europe have continued to influence gold’s safe-haven appeal. However, legal developments surrounding global trade and commodity regulations have not had any immediate large-scale impact on gold’s performance this week.

- Regulatory Oversight in the Gold Market: The London Bullion Market Association (LBMA) and other regulatory bodies continue to oversee trading and market activity in gold to ensure transparency and avoid market manipulation. As of the week, no major changes or regulations were implemented that directly affected the gold market.

XAU/USD Trade Recap & Outlook:

- Trade Summary:

Gold has shown moderate strength this week, supported by geopolitical uncertainties and ongoing concerns about inflation. Despite the hawkish Fed rhetoric, gold’s safe-haven status continues to offer support, although rising interest rates have capped its upside potential for now. - Potential Short-Term Correction: As RSI enters overbought territory, and given the proximity to resistance levels, there could be a short-term pullback from the current highs. The price could test the $4230 support zone, which is closely aligned with the EMA 50.

- Long-Term Bullish Trend: The bullish trend remains intact, with EMA 200 still below the current price, signaling that gold may see further upside in 2026 if inflationary pressures persist and economic instability continues. However, a break below $4230 would be critical to watch, as it could signal a deeper retracement.

Trading Strategy for the Week Ahead (December 11, 2025 and Beyond):

- Short-Term Traders:

- If gold remains near $4275-$4305, consider looking for short opportunities near resistance with a tight stop-loss just above $4305.

- A break below $4230 could indicate a deeper pullback, with next support levels around $4200 and $4150.

- Long-Term Traders:

- The overall trend is still bullish, with strong support near $4200. Traders should consider buying on dips if price retraces to the EMA 50 region, with a target of $4350 and above for the next leg up.

Conclusion

Gold’s performance this week has been characterized by modest volatility and continued bullish sentiment, driven by factors such as geopolitical instability, inflation concerns, and institutional buying. While short-term corrections may occur due to an overbought RSI and strong USD, the long-term outlook remains favorable for gold, especially if inflationary pressures continue. Traders should stay vigilant around key support and resistance levels, while keeping an eye on central bank actions and economic indicators that could further influence the precious metals market.

Looking ahead to the next week, gold’s price action will likely continue to be influenced by US economic data, geopolitical developments, and the broader trend in risk sentiment.

X